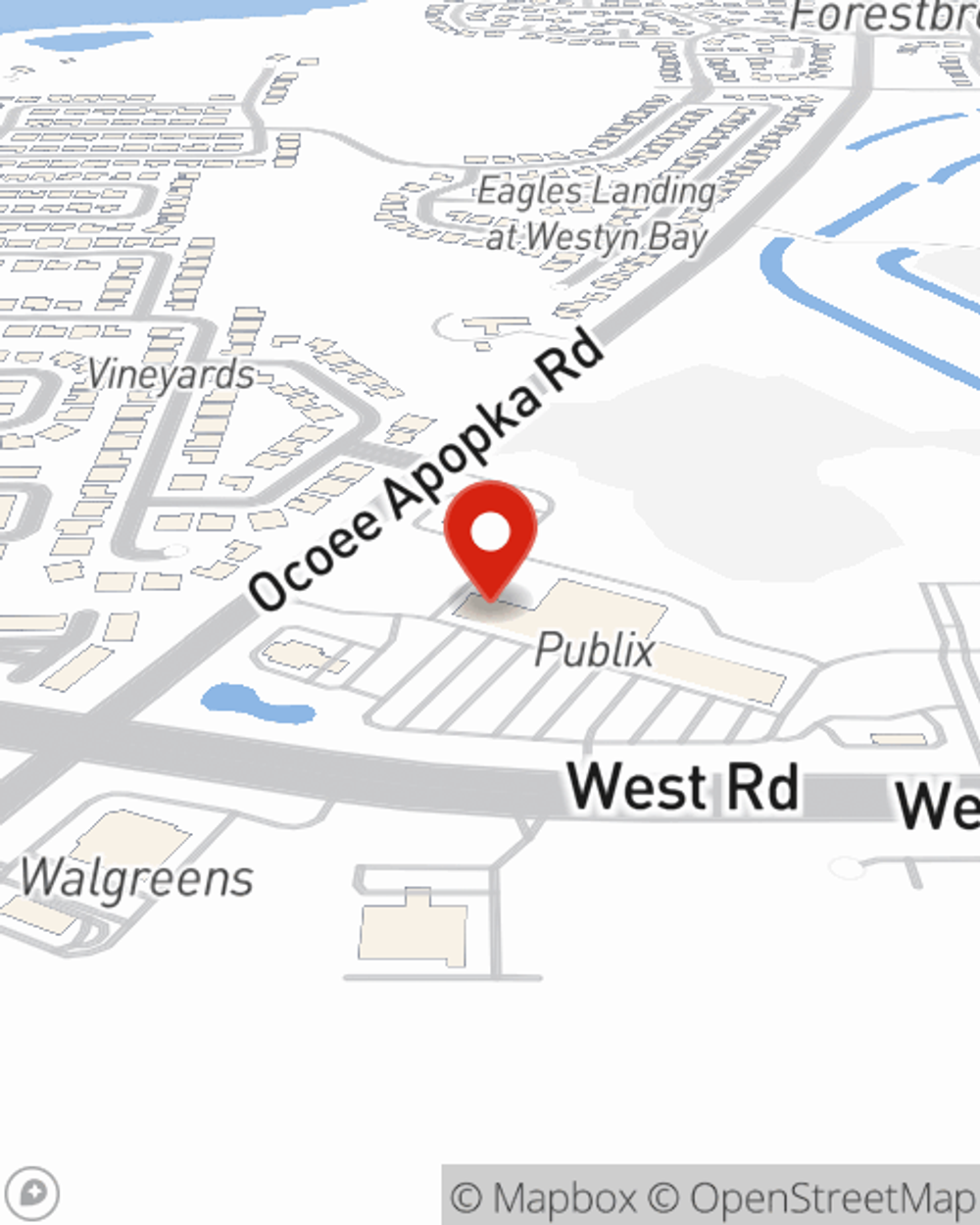

Life Insurance in and around Ocoee

State Farm can help insure you and your loved ones

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

- Florida

Check Out Life Insurance Options With State Farm

No one likes to think about death. But taking the time now to plan a life insurance policy with State Farm is a way to express love to the people you're closest to if the worst happens.

State Farm can help insure you and your loved ones

Life won't wait. Neither should you.

Love Well With Life Insurance

Having the right life insurance coverage can help loss be a bit less stressful for those closest to you and give time to recover. It can also help cover current and future needs like grocery bills, future savings and home repair costs.

When you and your family are insured by State Farm, you might rest assured that even if the worst comes to pass, your loved ones may be covered. Call or go online now and find out how State Farm agent Jo Barsh can help you protect your future.

Have More Questions About Life Insurance?

Call Jo at (407) 299-0301 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

When should I update my estate plan?

When should I update my estate plan?

Marriage, death and divorce are, of course, reasons to update an estate plan. We review other times to review what's included in this financial document.

Is term life insurance right for your family?

Is term life insurance right for your family?

Term life insurance policies offer easy, affordable coverage for families and other people seeking life insurance protection for a specific period of time.

Simple Insights®

When should I update my estate plan?

When should I update my estate plan?

Marriage, death and divorce are, of course, reasons to update an estate plan. We review other times to review what's included in this financial document.

Is term life insurance right for your family?

Is term life insurance right for your family?

Term life insurance policies offer easy, affordable coverage for families and other people seeking life insurance protection for a specific period of time.